Buy-Now-Pay-Later – How will this payment model help the brand or seller?

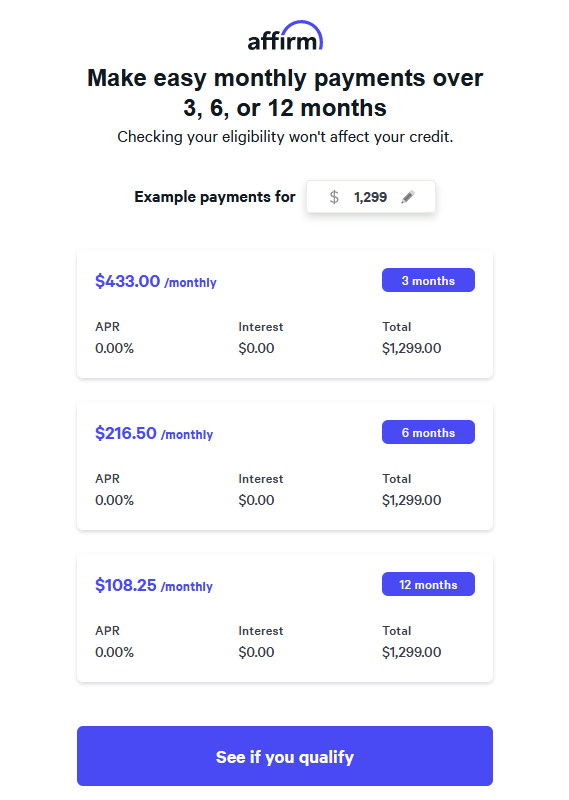

Following the growth of e-commerce, the popularity of the “Buy Now, PayLater” services under the general name BNPL is growing. This payment model implies the payment for the purchase is made by installments – the first share is paid at the time of sale; the following payments are debited from the client’s card according to a specific schedule. The service provider – as a rule, is a non-banking organization – immediately transfers the total cost of the goods to the seller. In this case, the service is paid for by the seller. The client receives the goods at their original cost. Because the payment is divided into four parts, it is called “Payin 4”.

Before BNPL, buyers used other models:

- A bank loan for consumer purposes (the so-called cash loan)

- Credit card

- Bank installments in places of major purchases

- Interest-free installments from the stores themselves

BNPL differs from installments done in stores in that in the payment scheme is not only a seller and a buyer, but a service provider also appears, who ensures the operation of the entire model. The largest specialized platforms are Klarna, Affirm, AfterPay, Sezzle. Recently, banks and large payment systems such as Mastercard, Visa, Square, and PayPal have begun to join the growing trend.

The difference from banking products is in the absence of interest for the use of funds for the buyer. In addition, a loan agreement is not concluded, and the client’s solvency is assessed according to a simplified procedure. At the same time, BNPL platforms limit one client’s total purchases to reduce their risks. As a rule, the limit is $ 1000 – 2500 but can reach up to $ 10,000. The term of total payment is also reduced, from several weeks to a year. It is assumed that there will be no dramatic changes in the buyer’s financial situation during this time.

The seller pays for the costs of the service, and the commission is significant – for example, AfterPay takes 3-6% from retailers. Why do sellers need additional charges?

The fact is that the possibility of a payment in installments when you do not need to fill out questionnaires and wait for an answer from the bank changes the behavior of consumers. The purchase is made quickly and easily and dividing the payment into parts reduces the consumer’s pain from parting with money. According to RBC Capital Markets, conversion to purchase increases by 20-30%, and the average check by 30-50%.

In addition, the seller gets access to the clients of the BNPL partner and his marketing campaigns. For advanced installment platforms, this advantage turns out to be even more critical. Sellers are willing to pay from 4 to 12% of the transaction amount for transitions from the BNPL application.

The average age of consumers in this model is about 30 years, and 25% are between 18 and 24. Women make up 75% of users of BNPL services. Most sales fall on clothes, shoes (their share is 90%), accessories, cosmetics, and electronics. Recently, goods for sports and outdoor activities and home accessories have been added.

In 2016, the share of this payment method accounted for 0.4% of world trade, and in 2021 – already 2.1%. The volume of the global market for BNPL payments is $ 6 billion. It is predicted that it will grow at an average rate of 26% per year and, in 2030, will be 39.41%. One of the most famous players – the Swedish company Klarna – has 90 million active users in 17 countries, making about 2 million daily transactions.

The BNPL model has been developing since the 2008 crisis in the US and Europe. In current conditions, when one crisis follows another, and real incomes of the population are declining in the wake of inflation, Pay-in-4 is a significant help for retailers in the competitive struggle.

Conventionally, users of BNPL services can be divided into the following categories:

- “Thoughtful” – buyers with a stable income who often use online stores and are looking for more attractive purchasing opportunities

- “Careless” – buyers who have exhausted their limit on a credit card but expect to soon solve all problems with the help of new receipts

- “Problem solvers” – buyers who need to make an urgent purchase due to circumstances: buy a new thing to replace a broken one, get ready for an unforeseen trip, make an unexpected gift.

Once using such a model, buyers return to it repeatedly because interest-free installments are very tempting for consumers. That is why BNPL services have a great future. They grow as more and more partners join them. Another vector of development is access to offline points of sale, the already existing technical capabilities.

However, the main driver of growth is the ongoing retail transition to online. Issuing a credit card or even an installment card is an action that requires some effort and time. To use the BNPL service, you need only a few clicks.

The growing popularity of BNPL services tells us how much more essential customers have become to brands and manufacturers and indicates an increase in competition. The additional service increases customer loyalty and improves the user experience, creating brand loyalty. For business, this model allows you to increase sales and the average charge at the expense of those who previously did not dare to make a purchase because of its increased cost, so the buyer can afford to buy more at a higher price thanks to the increased payment period.

Syntes is an outsourcing partner of well-known global brands for connecting, integrating, and developing D2C sales channels. Please contact us for advice if you need help growing your online store or launching new online sales channels. We will help you to implement the most effective practices and increase the profit of your e-commerce business.

Syntes, an international company, develops a next-generation MDM (Master Data Management) and PIM (Product Information Management) cloud platform and provides brands and manufacturers with services for creating, managing and automating D2C (Direct-to-Customer) sales and marketing channels. Syntes solutions and services are used by the world’s leading brands and manufacturers of consumer and business products such as Razer, Scarlett, Pantone, X-Rite, AVerMedia and others. Syntes is a registered trademark of Syntes, Inc.

Mentioned trademarks and company names are registered trademarks of their respective owners.

© Copyright Syntes, Inc. Copying, reprinting, and any reproduction is permitted only with the written permission from Syntes, Inc.